A good early indicator for how the housing market is responding to the recent sharp rise in mortgage rates is new home sales cancellation rates.

The long-term average cancellation rate for Southern California as a whole is about 15% to 16%.

The last time interest rates spiked was in 2018 when mortgage rates rose 90 basis points (from 4.0% to 4.9%) over the first 11 months of the year.

Subsequently, new home cancellations steadily rose during this period, reaching 22% to 30% in all major Southern California markets.

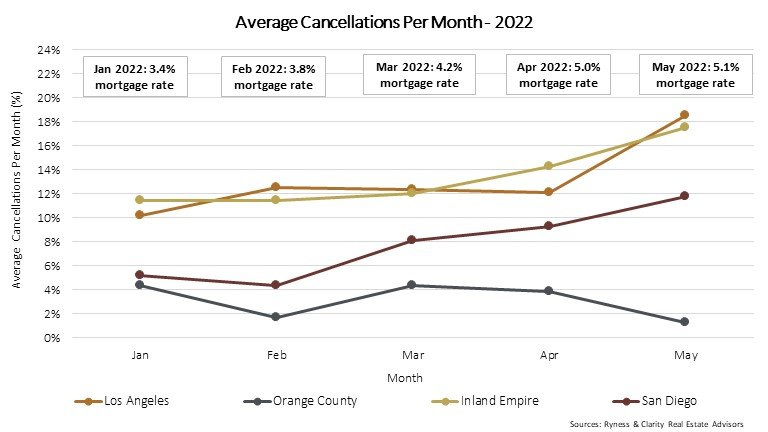

During the first 5 months of 2022, mortgage rates have increased about 170 basis points (3.4% to 5.1%). In response, cancellation rates are up in most, but not all, Southern California markets.

In high-cost Orange County, cancellation rates are actually down and are currently at a historic low (1.0%).

Although trending upward, current cancellation rates in San Diego, Los Angeles, and the Inland Empire are now in the 12% to 19% range; generally, within the range or slightly above the long-term average.

Should interest rates rise further, we do anticipate cancellation rates rising to the range seen at the end of 2018; however, if rates stabilize or decline, cancellation rates likely will decline as well.

Reasons recent cancellation rates have not reached late-2018 levels include:

Very low new and resale housing supply in all markets has resulted in a demand/supply imbalance; funneling demand into fewer projects and helping to keep per project sales rates high. The number of actively selling new home communities in Orange County and San Diego County are currently about half of the total in 2018.

Buyers in the high-priced Orange County market are typically less interest rate sensitive, which could partially contribute to the very low cancellation rate. However, cancellation rates in Orange County spiked to 29% in late-2018 when rates were lower than they are currently.

Fluctuating or rapidly rising interest rate environments can have a psychological effect on potential buyers and motivate “fence-sitters” to buy before rates move up any higher.

Record-high inflation is motivating people to buy hard assets such as homes for personal use or investment.

COVID-19 has increased the demand for new housing as many households are reassessing their current living situation. In addition, the work-from-home trend has increased demand from buyers coming out of more urban areas. Households who otherwise were not in the market for a new home are now deciding to move, increasing the demand for new construction homes.

So far, a high proportion of builders have been able to replace cancellations from long interest lists of buyers.

In a check with sales agents at Southern California new home projects over the past week, most indicated that they still have hundreds, if not thousands, of prospective homebuyers still on active interest lists.

Although we expect that the recent rise in interest rates will eventually moderate sales and price growth for the remainder of 2022, current cancellation trends are typical of periods in the past with rate increases and have not yet had a significant slowing impact on new home sales.